is a tax refund considered income for unemployment

It is included in your taxable income for the tax year. You must report them on Schedule A of Form 1040 if you claimed a deduction for.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Taxpayers should not have been taxed on up to 10200 of the unemployment compensation.

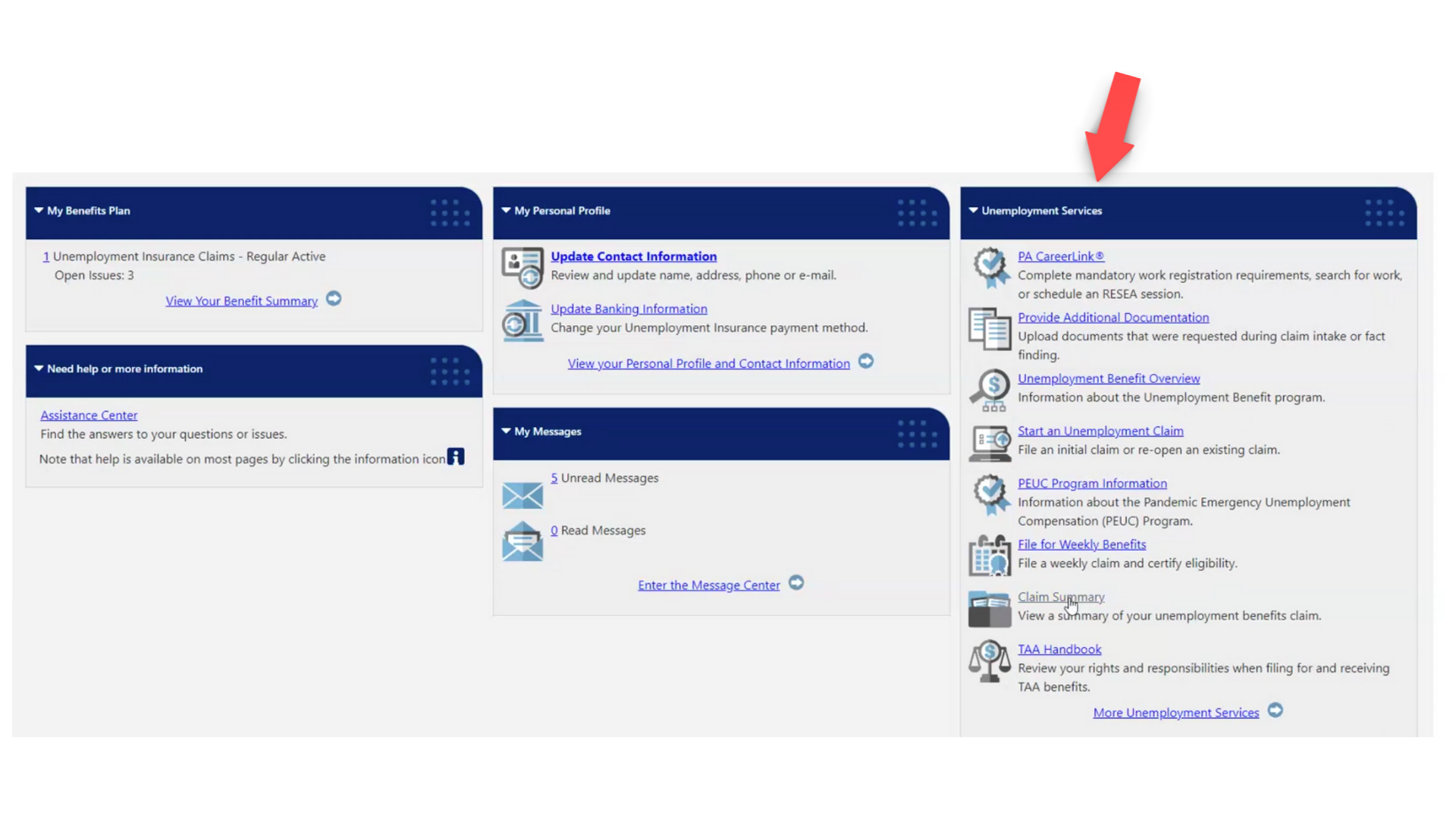

. Rules If you are unemployed or out of work sick If tax has been deducted from your. Unemployment income is considered taxable income and must be reported on your tax return. This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return.

This IRS form will show the state and federal benefits you received during your tax year. The questions indicates that you are in the incorrect data entry for the unemployment compensation form 1099-G you have somehow selected Other 1099-G. You have to pay federal.

While the federal government. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. The federal tax code counts jobless benefits as taxable income.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. You may have been unemployed but its still income and consequently still subject to income tax. Under the American Rescue Plan signed into law Thursday the IRS will make the first 10200 in unemployment benefits from 2020 tax-free.

Typically unemployment insurance benefits are subject to federal income tax. Receiving unemployment benefits is no different from earning a paycheck when it comes to income taxes at least under normal circumstances when the US. This is not the amount of the refund taxpayers will receive.

The amount of the refund will vary per person depending on overall. Unemployment income is considered taxable income and must be reported on your tax return. Your income tax refund is taxes that you overpaid.

Earned Income would be monetary payments for services rendered. Taxpayers who received unemployment benefits and did not withhold any federal or state income tax. A tax refund may also be paid if you have purchased goods or services for which you can claim tax relief.

It is included in your taxable income for the tax year. Set Money Aside to Cover Unexpected Unemployment Benefit Taxes. Depending on your circumstances you may receive a.

Under normal circumstances receiving unemployment would result in a reduction of both. While the federal government. While unemployment benefits are taxable they arent considered earned income.

Most unemployment insurance premiums are paid by your employer and benefits are considered taxable income to you. Its also required to report any severance pay pension payments and. However taxpayers pay unemployment insurance.

Any unemployment compensation in excess of 10200. Unemployment benefits are taxable income so recipients must file a Federal tax return and pay taxes on those benefits. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of.

Youâll need to report this amount on your federal tax return. An Axios piece warned that recipients of unemployment insurance benefits may receive a smaller tax refund or owe taxes due to a quirk in the tax code that. State income tax refunds can sometimes be considered taxable income according to the IRS.

Taxpayers dont need to worry about paying more taxes on the refund they received since its technically the taxpayers money. The IRS will recalculate any other credit or deduction that was claimed on the original return that was impacted by this automatic correction. A tax refund on your federal income tax isnt considered income.

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Some May Receive Extra Irs Tax Refund For Unemployment

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Dor Unemployment Compensation State Taxes

Asked And Answered Filing Taxes While On Unemployment

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Tax Issues With Unemployment Benefits Get More Complicated Wgrz Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Are Unemployment Benefits Taxable Wcnc Com

Unemployment Benefits Tax Issues Uchelp Org

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

![]()

What To Know About Unemployment Refund Irs Payment Schedule More